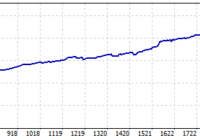

The Sharpe ratio is interpreted as follows:Sharpe Ratio < 0 Poor. The strategy is generally unprofitable.Sharpe Ratio < 1.0 Undefined. The risks are not justified. The use of such strategies can only be considered when there are no alternatives.Sharpe Ratio ≥ 1.0 Good. If the Sharpe Ratio is higher than one, it means that the risks are justified by the portfolio/strategy performance.Sharpe Ratio ≥ 3.0 Excellent. A high ratio indicates lower probability of losses in…

Read More