Rule #1 – There would always be a question mark on if it would be successful or not?

Once you google “The Tortoise Trainer” you will get the most expensive piece of art in Turkish Painting – Painted by Osman Hamdi.

The Tortoise Trainer is a painting by Osman Hamdi Bey, with a first version created in 1906 and a second in 1907. Hamdi’s painting of an anachronistic historical character attempting to train tortoises is usually interpreted as a satire on the slow and ineffective attempts at reforming the Ottoman Empire.

The painting depicts an elderly man in traditional Ottoman religious costume: a long red garment with embroidered hem, belted at the waist, and a Turkish turban. The figure is a self-portrait of Hamdi himself. He holds a traditional ney – flute and bears a nakkare drum on his back, with a drumstick handing to his front. The man’s costume and instruments suggests he may be a Dervish.

The scene is set in a dilapidated upper room at the Green Mosque, Bursa, where the man is attempting to “train” the five tortoises at his feet, but they are ignoring him preferring instead to eat the green leaves on the floor. Above a pointed window is the inscription: “Şifa’al-kulûp lika’al Mahbub” (“The healing of the hearts is meeting with the beloved”).

The first version of Hamdi’s painting was exhibited at the Grand Palais in the 1906 Paris Salon, under the title L’homme aux Tortues (“Man with tortoises”). It was formerly in the collection of the businessman Erol Aksoy. It was sold for US$3.5 million in 2004 and is currently displayed at the Pera Museum in Istanbul.

A second smaller version was completed in 1907, dedicated to his child’s father-in-law, Salih Münir Pasha. The second version was bought by the journalist Erol Simavi in the 1980s, and was exhibited at the Sakıp Sabancı Museum in 2009.

Both may be inspired by an article that Hamdi read in the Le Tour du Monde travel journal decades before, which described Korean tortoise trainers in Japan, who trained their animals to walk in lines to the beat of a drum.

Osman Hamdi Bey created the painting at a time of great social and political turmoil in the Ottoman Empire. The reforms introduced by Sultan Abdülhamid II had either proved ineffective, or had been blamed for the increased upheaval. The Ottoman Empire, which still encompassed parts of the Balkan peninsula, parts of North Africa, all of Anatolia and the Levant, and much of the Arabian peninsula at the turn of the 20th century, was under serious threat from both the growing power of nationalist movements within its territory, and from the incursions of foreign powers which would eventually divide the Empire between them in the aftermath of the First World War.

Are turtles and tortoises smart enough to be trained or perform tricks?

Oh, absolutely. Some species have been shown to be relatively brilliant – doing better at navigating mazes than many mammals.

The important thing to remember with reptiles is that…

Rule #2 – They fatigue easily, the temperature and environment MUST be correct for their stress level to be low enough for training (and for their brain to function optimally)

Rule #3 – You need to find a sufficient motivator. Fortunately, turtles and tortoises are usually very food-motivated, which makes them easy to train.

(Snakes, conversely, are almost impossible to train, because they eat only once a week – there’s just nothing they want badly enough to perform, and once a week isn’t much repetition for a training exercise).

Do I need experience or do I need expert? There is always a question mark if a company requires an expert to guide them in their transformation journey or is it the experience in the company that drives the transformation? It is a complex formula. My take a way is – (regardless of how difficult it is)

Rule #4 – You need to have experience in finding the right experts and Every Expertise can be Thought

Come on some complex problems can not be thought to ordinary people. You would need extra skills to master and learn and execute… Right – No… This is a long debate. Let me give the best example.

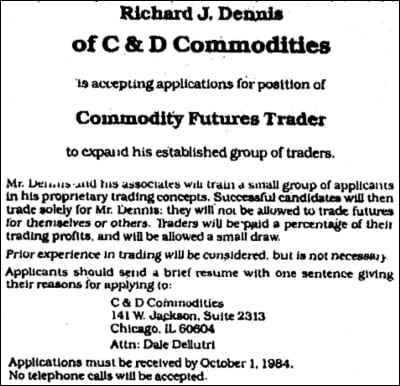

Now lets read this add. I would argue this is the best example that I can think of.

The Turtle Traders experiment was conducted in the early 1980s by Richard Dennis and William Eckhardt to see whether anyone could be taught how to make money trading. The experiment involved taking a random group of people, teaching them a set of rules to follow, and seeing how successfully they traded.

The Beginning

In the early 1980s, Richard Dennis was a well-known trader who found considerable financial success, starting with less than 5,000 and turning it into over 100 million. Dennis’s partner, William Eckhardt, believed Dennis’s success was only possible because Dennis had a unique gift. Dennis disagreed. Dennis based his trading on a specific set of rules. He thought anyone who learned and followed his rules could become a successful trader.

The two regularly discussed this topic, and finally, they decided to experiment to see who was right. Dennis would find a group of people, spend two weeks training them to follow his trading rules, and then let them start trading. He could then repeat this process over and over. Dennis felt so confident in the methods that he gave the traders his own money to trade. Bill Eckhardt and Richard Dennis can be seen below.

Dennis began referring to his students as “turtles” since he believed he could quickly and efficiently produce traders the way he had seen turtle farmers in Singapore efficiently and rapidly create turtles.

At this time, Dennis was a well-known trader offering everyday people the chance to make large amounts of money. Not surprisingly, thousands of people applied. Dennis picked only fourteen from these thousands to be part of the inaugural group.

Dennis never explained how he chose his turtles from the thousands that applied. We know that a set of true or false questions was one part of the screening process. The 63 true or false questions Dennis asked included the following:

Big money in trading is made when one can get long at lows after a significant downtrend.

Diversification is better than always being in 1 or 2 markets.

Others’ opinions on the market are good to follow.

The majority of traders are always wrong.

If one has $10,000 to risk, one should risk $2,500 on every trade.

The turtle trader experiment is often compared to picking a random person off the street, providing them with two weeks of training, and then sending them off to become millionaires. While the turtles were not successful and well-known traders, they knew who Richard Dennis was, wanted to train with him, knew enough about trading to answer his questions, and most likely already had similar trading beliefs to Dennis.

What the Turtles Learned

During the two-week training, Dennis taught the turtles his Turtle Trading rules and philosophy.

Rule #5 – This training taught the turtles to approach trading with the scientific method

The method would be the philosophical foundation for all of their trading. The scientific method relies on numerical data that can be observed and measured. The steps of the scientific method are:

Define the question

Gather information

Form a hypothesis

Design an experiment to test the hypothesis

Experiment and collect data

Analyze the data from your experiment

Interpret the data

You accept the theory and report the findings if the data matches the hypothesis. If the evidence does not fit the hypothesis, you refine the thesis and begin the process over.

Dennis taught his turtles to rely on the scientific method to minimize the psychological impacts of trading that could cause traders to make mistakes and lose significant amounts of money. In this respect, Dennis was ahead of his time. This was 1983, and Dennis put into practice some of the basic concepts of “prospect theory, ” which Daniel Kahneman would win a Nobel Memorial Prize in Economic Sciences in 2002.

Kahneman points to the fact that one has to be extremely cautious in financial decisions. He calls it risky, if not dangerous, when people who have little knowledge of the financial system need to make decisions about which stocks to buy for their retirement, for example. “That becomes silly,” he quips. “The assumption that individual investors are rational. That leads to serious mistakes.”

With Prospect Theory, the work for which Kahneman won the Nobel Prize, he proposed a change to the way we think about decisions when facing risk, especially financial. Alongside Tversky, they found that people aren’t first and foremost foresighted utility maximizers but react to changes in terms of gains and losses. “Gains and losses are short-term,” he says. “They’re immediate, emotional reactions. This makes an enormous difference to the quality of decisions.”

He argues that when people think of the future, they think of the near future far more than the distant future. Changing the perspective from people looking to obtain long-term wealth, to people not wanting to lose tomorrow, significantly alters our understanding of behavior. “People put much more weight on losses than gains. People hate losing.”

Beyond using the scientific method, Dennis also taught the turtles to internalize some core concepts that speculators had been using for over a century. The core concepts Dennis taught were:

Rule #6 – Internalize some core concepts that competition had been using for over a century

“Do not let emotions fluctuate with the up and down of your capital.”

“Be consistent and even-tempered.”

“Judge yourself not by the outcome but by your process.”

“Know what you are going to do when the market does what it will do.”

“Every now and then, the impossible can and will happen.”

“Know each day what your plan and your contingencies are for the next day.”

“What can I win, and what can I lose? What are the probabilities of either happening?”

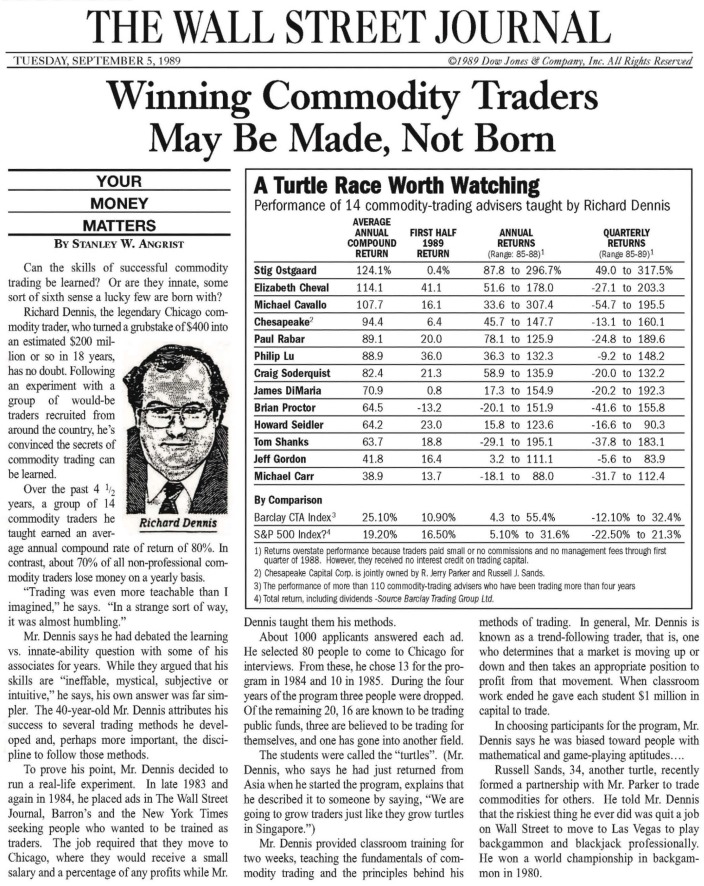

Did It Work?

According to former turtle Russell Sands, as a group, the two classes of turtles Dennis personally trained earned more than $175 million in only five years. Dennis had proved beyond a doubt that beginners can learn to trade successfully. Sands contends that the system still works well and said that if you started with $10,000 at the beginning of 2007 and followed the original turtle rules, you would have ended the year with $25,000.