6 May 2010:

Stock prices can go down as well as up. Never in financial history has this adage been more apt than on 6 May 2010. Then, the so-called “Flash Crash” sent shocks waves through global equity markets. The Dow Jones experienced its largest ever intraday point fall, losing $1 trillion of market value in the space of half an hour. History is full of such fat-tailed falls in stocks. Was this just another to add to the list, perhaps compressed into a smaller time window?

No. This one was different. For a time, equity prices of some of the world’s biggest companies were in freefall. They appeared to be in a race to zero. Peak to trough, Accenture shares fell by over 99%, from $40 to $0.01. At precisely the same time, shares in Sotheby’s rose three thousand-fold, from $34 to $99,999.99. These tails were not just fatter and faster. They wagged up as well as down.

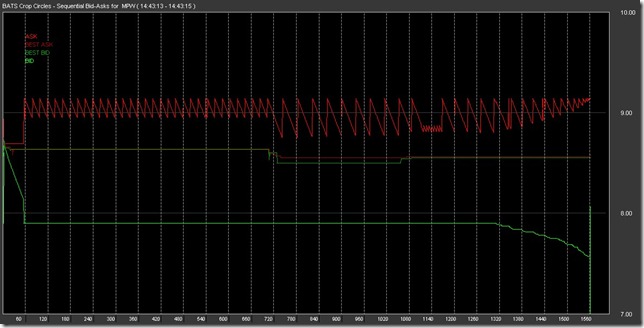

This is the Flash Crash:

we remain unsure quite what caused the Flash Crash or whether it could recur.

You can read more at: The race to zero In a speech at the International Economic Association Sixteenth World Congress in Beijing, Andrew Haldane – Executive Director for Financial Stability and member of the interim Financial Policy Committee – outlines how dramatic shifts in the structure and speed of trading have increased abnormalities in the pricing of securities.

Nanex is an interesting company.

In their site they say”NxCore (pronounced n’core) is a high-performance, real-time streaming datafeed (ticker plant) that brings the whole market to your workstation or desktop computer. NxCore excels in delivering and databasing all the quotes and trades transmitted by the exchanges, even in the hyper-active U.S. Option market (OPRA) which now transmits over 4,500,000 quotes per second, and 8 billion quotes per trading day.”

Imagine if you were using that much of information and enough mathematicians to come up with “clever” algorithms for trading. CLEVER? İn nanex web site they disclose some interesting research as well. (That made them very special for my work) NANEX Research. The news in the list is amazing. They publish about the CLEVER algorithms that they notice. You can read about DELL, NVIDIA, etc stories. Those are called BUGS in software development. They are the bugs running through financial markets. Unfortunately there is no way we can see them. Except web sites like NANEX research.

As performance of CPU’s increase the High Frequency Trading is also increasing. the Graph above clearly shows this trend. Where will it stop is an other question?

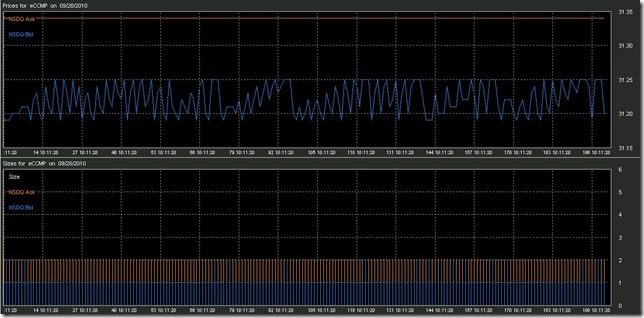

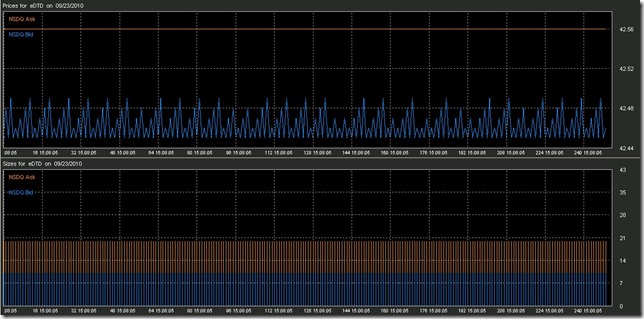

Look at those CLEVER trading out comes!

Blue Zinger

Detox

Knife

So CLEVER.